• Uranium was produced from the Dornod deposit in Mongolia by Russian interests to 1995.

• Mongolia has substantial known uranium resources and geological prospectivity for more.

• Since 2008 Russia has re-established its position in developing Mongolian uranium.

• There is currently no uranium mining in Mongolia.

According to the 2011 ‘Red Book’, Mongolia has 74,000 tU in Reasonably Assured Resources plus Inferred Resources, to US$ 130/kg U. However, geological indications reported in the Red Book suggest that uranium resources could be 1.47 million tU.

The mining sector is Mongolia’s single largest industry, accounting for 55% of industrial output and more than 40% of export earnings. The new $4.5 billion Ivanhoe-RioTinto Oyu Tolgoi copper-gold project will boost this.

However, the country has been considered to have relatively high political risk associated with investment. One aspect of this was the existence of an eminent domain provision for strategic minerals which involved the possibility of claw-back at the discretion of the government, applied where new exploration covered areas which were previously explored or developed, such as Dornod and Gurvanbulag. Originally this was understood to involve compensation if it were invoked, but this provision was abolished in the July 2009 Nuclear Energy Law.

Coal provides 80% of its electricity (3 billiion kWh in 2009), from less than 1 GWe capacity, and 13% of electricity is imported from Russia. A 220 kV transmission line is built to import electricity from China for the Oyu Tolgoi /Turquoise Hill mine in the Gobi desert, which is 550 km south of Ulaan Baatar but only 80 km from China.

Air pollution is a major problem in Ulaan Baatar, from domestic combustion, cars, and power generation.

Background

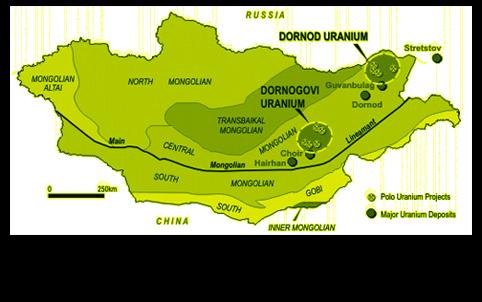

Mongolia has a long history of uranium exploration commencing with joint Russian and Mongolian endeavours from 1950s involving investment of some US$ 200 million. Initial success was obtained in the Saddle Hills area of northeastern Mongolia (Dornod and Gurvanbulag regions) where uranium is present in volcanogenic sediments. Prior to 1960, numerous uranium occurrences were discovered in the deposits of brown coal in eastern Mongolia. Over 1970-90 government geological surveys covered much of the country, and based on these the country was classified into four uranium provinces: Mongol-Priargun, Gobi-Tamsag, Khentei-Daur and Northern Mongolian. Each has different geology and hosts different deposit types. Within these provinces, nine uranium deposits and about 100 uranium occurrences were identified.

The Mongol-Priargun uranium province includes the main uranium prospects, Dornod and Gurvanbulag, in the east and northeast of the country, in volcanogenic mineralisation. The Gobi-Tamsag uranium province in southern Mongolia includes the smaller Dulaan Uul and Nars deposits in sediments.

The Dornod open cut mine and undergound orebody, with the surrounding area containing a number of deposits, is in the Dornod aimag (province). The main deposit was mined by the Erdes Mining Enterprise, a subsidiary of Priargunsky Industrial Mining & Chemical Union from 1988 to 1995. The ore was railed 480 km to Krasnokamensk in Siberia for treatment by Priargunsky. About 535 tU was produced, all from open pit mining.

Mardai township close to Dornod was built in the 1970s and was reported to house 10,000 Russian workers at the mine with a very high standard of living and commerce. It is now in ruins, also the railway north has been removed and the materials sold.

Atomredmetzoloto (ARMZ) says that Russia spent the equivalent of $600 million (in 2009 dollars) on uranium exploration and development in Mongolia to 1995.

In April 2008 Russia and Mongolia signed a high-level agreement to cooperate in identifying and developing Mongolia’s uranium resources. This aimed to restore and consolidate Russia’s involvement in Mongolia’s uranium sector, notably Dornod. This was taken forward by further bilateral agreements in August 2009 and December 2010, and in Russian legislation signed into law in January 2011 ratifying establishment of the joint limited liability company Dornod Uran, 49% owned by ARMZ.

Legislation and government entities

Since 1956 the Joint Institute for Nuclear Research (JINR) at Dubna, near Moscow, has trained Mongolian scientists. A Nuclear Energy Commission was set up in the 1980s.

In 2008 the government established a new Ministry of Minerals and Energy. Then the Nuclear Energy Agency (NEA) was set up about the beginning of 2009 as a policy and regulatory body and government line agency directly accountable to the Prime Minister. In February 2009 the government set up MonAtom LLC to undertake uranium exploration and mining on behalf of the state, as well as pursuing nuclear energy proposals. It will hold the state’s equity in uranium and nuclear ventures and so comes under the Nuclear Energy Agency and the State Property Committee. The Radiation Control Authority is a part of this Agency, along with MonAtom. The existing Mineral Resources Authority of Mongolia (MRAM) is expected to work closely with MonAtom and the Nuclear Energy Agency.

In mid July 2009, after consultation with the International Atomic Energy Agency, parliament passed a Nuclear Energy Law to regulate the exploration, development, and mining of uranium and give the state a greater degree of ownership and control of uranium resources. It included transitional provisions dealing with existing mining and exploration licences. The new Law gives the government the right to take ownership without payment of not less than 51% of the shares of a project or joint venture if the uranium mineralisation was discovered by state funded exploration, and not less than 34% if state funding was not used to find the mineralisation. It gives the State Administrative Authority the responsibility to implement and enforce state policy on the exploration and development of deposits of radioactive minerals and establishment of nuclear energy, including the power to grant, suspend or revoke any licences granted pursuant to the Nuclear Energy Law. Licences to conduct uranium exploration and production of any radioactive minerals must be obtained under this law.

Parliament also passed legislation regarding the re-registration of existing exploration and mining licences. Existing licence holders had to apply to the State Administrative Authority by 15 November 2009 and comply with all of the conditions and requirements set out in the Nuclear Energy Law, including acceptance of the state’s 34% or 51% share participation in the licence holder.

A new law on Radiation Protection and Safety was enacted in 2001, replacing 1977 and 1983 provisions.

Other deposits and interests

Canada’s Denison Mines has an 85% interest in the Gurvan Saikhan Joint Venture (GSJV), (having bought out a 15% Russian partner early in 2012), with Monatom 15% but restructuring is under way. Monatom is entitled to up to 51% under the nuclear energy law, and may end up with 34%. Denison also holds some leases though its Mongolian affiliate International Uranium Mongolia XXK (IUM). GSJV has focused on defining ore which is amenable to in situ leach (ISL) mining, and it holds interests in several Mongolian properties in Omnogovi (Soputh Gobi). In 2007 and 2011 NI 43-101 resource figures were published for some of these. Indicated resources are 7600 tU and inferred resources are 2200 tU for Hairhan/ Khairkhan, and 2400 tU for Haraat/ Kharaat, due west of Sainshand. It plans to star an ISL operation on these two in 2013. Denison reports work on Urt Tsav and Ulziit properties.

Areva has been conducting exploration since 1996, lately through 100% subsidiary Areva Mongol LLC which holds extensive tenements in Dornogovi and also Sukhbaatar provinces (Sukhbaatar is between Dornogovi and Dornod). In 2007 it took over East Asia Minerals Energy Co. It signed agreements in about 2006 regarding prospects near Sainshand in Dornogovi. An Areva Mongol subsidiary, Coge-gobi LLC, has been trialling ISL at Dulaan Uul in the Ooshlin Govi Basin of Dornogovi province, and plans to start mining in 2013. Cogegobi was originally (1996) a JV with 30% held by Goeo, but this share passed to Areva Mongol in 2008. Areva projects some 1000 tU/yr production as possible after 2016 from Sainshand uranium province in Dornogovi.

Solomon Resources of Canada is exploring on its Baruunbaayan uranium project in the west of Dornogovi province, and following the new 2009 Nuclear Energy law its main exploration licence immediately west of the Areva tenements in the Ooshlin Govi Basin was granted.

In 2007 Century City International of Hong Kong entered into an agreement with China Nuclear Energy Industry Corp (CNEIC), a subsidiary of CNNC, to explore and develop uranium resources on its leases in eastern Mongolia.

Red Hill Energy holds a number of exploration licences including the Emeelt deposit in the Ulaan Nuur fault zone of Dornogovi, Khashaat in Omnigovi and Baganurat 350 km southeast of Ulaan Baatar, and Jargalan, 500 km west of the city In December 2008 Japanese trading company Marubeni acquired rights to conduct feasibility studies on three uranium deposits, including Dornod and Gurvanbulag, developed by KRI and Western Prospector. The company planned to invest US$ 430 million and had signed a letter of intent with Khan. Since it was perceived that the laws of the mining-dependent country had become increasingly protectionist in recent years, Khan Resources then commented that “We are excited by Marubeni’s interest in Khan’s Dornod uranium project and are optimistic about the positive influence Japanese investors have on the Mongolian mining investment environment. Marubeni will work to improve the mining investment climate in Mongolia.” MonAtom and Rosatom have both said that a Japanese company, presumably Marubeni, may be involved with the Dornod project JV.

In September 2009 India signed a uranium supply and nuclear cooperation agreement with Mongolia.

Nuclear power proposals

Russia is examining the feasibility of building nuclear power plants in Mongolia. The Nuclear Energy Agency has tentative plans for developing nuclear power, using either Korean Smart reactors or Toshiba 4S types, from 2021. Three sites under consideration are Ulaan Baatar, western Mongolia and Dornod province.

Non-Proliferation

Mongolia joined the IAEA in 1993, though it has applied safeguards under the NPT since 1972. A law on nuclear weapons-free status was passed in 2000. The Additional Protocol to its safeguards agreement with IAEA has been in force since May 2003.

undertaken for Khan had confirmed the viability of the project, the capital cost estimate being US$ 333 million and first production possibly in 2012. A definitive feasibility study released in March 2009 showed that the project was sound, on the basis of 24,780 tU indicated resources (NI 43-101 compliant), including 20,340 tU probable reserves. Annual production of 1150 tU over 15 years was envisaged.

In July 2009 MRAM suspended, it said for three months, the CAUC mining licence due to alleged violations of Mongolian laws. Then in late August the Nuclear Energy Agency announced that the Dornod Uran joint venture of MonAtom with Russia’s ARMZ would develop the project to produce about 2000 t/yr. Uranium would be exported but not necessarily to Russia. In mid January 2010 CAUC’s mining licence was restored by MRAM. Khan’s exploration licence was unaffected.

Khan had been granted a 3-year exploration licence from MRAM early in 2008 covering part of the Dornod orebody, and was applying to have this converted into a mining licence contiguous with that held by CAUC. In addition, subsidiary Khan Mongolia holds 100% of an exploration license covering an adjoining “Additional Dornod property”. In March 2009 Khan was reported as holding 58% of the No.2 deposit (open cut mine) and two thirds of the deep No.7 deposit (via CAUC?), and 100% of the remaining third of the No.7 deposit, which would give it 69% of the overall uranium resource. The company was aiming to negotiate an investment agreement with the government as soon as possible, and engineering was then likely to take three years to mine start up. On 27 November 2009 ARMZ announced a cash offer to buy all Khan’s shares, at a substantial premium on the market. ARMZ said that it believed “the offer represents full and fair value for the Khan shares and provides Khan shareholders with an opportunity to receive liquidity at a significant premium to the current market, as well as value certainty today, relative to the significant political and licensing risks associated with the development of the Dornod property in Mongolia.” On 15 December Khan’s board of directors unanimously recommended its shareholders reject the offer, describing it as inadequate, failing to recognize the full value of the company, and containing “objectionable” terms and conditions, as well as being “highly prejudicial and opportunistic” and exposing Khan to serious risks. On 25 January 2010 Khan announced that it had signed a memorandum of understanding with MonAtom to set up a joint venture and resolve the ownership of Dornod. It also creates a framework for developing the deposit and bringing it into production. The proposed corporate structure had MonAtom acquiring a 51% interest in both CAUC and Khan Mongolia, then after a share issue Khan would end up with 65% of the joint venture company, which in turn would own 74% of CAUC and 100% of Khan Mongolia, while MonAtom would own up to 20% of Khan.

But a week after this, on 1 February 2010, the Khan directors recommended a full takeover by a China National Nuclear Corporation subsidiary, CNNC Overseas Uranium Holding Ltd. The price was 118% higher than before Russia’s unsolicited bid in November 2009, and 48% above what they offered with some implied duress. The Khan CEO said: “We look forward to working with CNNC to build upon the progress we have made in Mongolia towards establishing a stable platform for developing the Dornod uranium project and bringing it into operation.” The CNNC bid was extended to 25 May 2010, apparently to allow time for Chinese government approval, but possibly also due to Mongolian government hostility.

However, ARMZ then extended its takeover offer for Khan, citing a Nuclear Energy Agency statement that some provisions of the Khan-Monatom agreement were contrary to Mongolian law and policy. ARMZ asserted that the agreement, “including its provisions on revising and granting a mining license to CAUC, as well as exploration licenses of Khan Mongolia, cannot be properly approved and do not comply with the existing legislation in Mongolia.” ARMZ also said that the agreement contravened Mongolia’s international obligations under the intergovernmental agreement between Mongolia and Russia of August 25, 2009, which provides for setting up the JV Dornod Uran to develop the Dornod uranium deposit.The ARMZ bid expired on 1 March 2010.

On 13 April 2010 Khan announced that it had received notice from the NEA that CAUC’s mining and exploration licences had been invalidated as of October 2009, purportedly due to the company’s failure to address issues identified in July 2009. Khan said it intended to challenge the ruling, and that “The NEA’s intention appears to be to invalidate our licenses, as well as potentially those held by other foreign companies operating in the region, with a view to transferring all of the mineral rights and interests in the entire Dornod uranium region to a ‘Dornod Uranium joint venture’ that is purportedly being established between the Russian and Mongolian Governments.”

On 21 April Khan announced that CAUC had filed a formal claim in the Capital City Administrative Court in Mongolia challenging the legal basis for the notice received from the Mongolian NEA purporting to invalidate CAUC’s mining license 237A and seeking a declaration that NEA’s action was invalid. It said that Khan Mongolia was preparing to file a similar claim in relation to exploration licence 9282X, and it had written on 15 April to the Prime minister of Mongolia appealing for his help. Khan then said that the CNNC takeover remained ongoing and should not be affected by “any expropriation of Khan’s properties or assets”. However, on 24 May CNNC Overseas Uranium Holdings informed Khan that its cash offer to acquire all Khan’s common shares would be allowed to expire following its failure to obtain regulatory approval from the Chinese government. The National Energy Administration, an arm of the Chinese National Development Reform Commission (NDRC), said that the offer was not approved.

In November 2010 the NEA announced that would not reinstate Khan’s licences.

On 10 January 2011 Khan announced it had “formally commenced an international arbitration action against the Government of Mongolia for its expropriatory and unlawful treatment of Khan”. In its initial filing, Khan alleged that the Mongolian government had “caused substantial loss and damage to claimants and their investments through expropriatory, unlawful, unfair, and discriminatory treatment” in connection with the Dornod uranium deposit. The arbitration brought by Khan and several of its subsidiaries will take place under the Arbitration Rules of the United Nations Commission on International Trade Law, and asserts claims under the Energy Charter Treaty, the Foreign Investment Law of Mongolia, and the Founding Agreement between Khan and the Mongolian Government. The claim was served on various officials of the Mongolian government, and seeks US$326 million in compensation for losses and damages.

Mongolia objected to the tribunal’s jurisdiction over the claim, but in July 2012 the tribunal upheld its jurisdiction over Khan’s claim both in relation to its merits and damages. In December 2012 Khan submitted seven volumes of evidence in support of its claim, containing thousands of pages of documents. The Mongolian government has until April 5, 2013 to respond, and in turn Kahn will have until June 28, 2013 to respond to Mongolia’s filings. The tribunal is scheduled to meet from November 11 to 15, 2013. A ruling is expected in the first half of 2014.

Khan is simultaneously engaged in a legal battle with Atomredmetzoloto (ARMZ). In August 2010, Khan filed a $300 million claim against ARMZ in a Canadian court on the basis of an alleged breach of fiduciary duties and damage to its rights, reputation, and property. Russia’s Justice Ministry refused to honor Khan’s request that it serve ARMZ with process. Khan then filed a motion with Ontario’s Supreme Court to validate the service of process. That court initially held for Khan, but on appeal held for ARMZ on the basis of the theory that Khan had not exhausted all process service options. In December 2012 Khan was appealing the decision.